Do you actually understand your car insurance coverage?

In my many years as a personal injury lawyer, I’ve met a lot of smart people who don’t know anything about the insurance policy they spend hundreds of dollars on every month.

Here’s a quick-and-easy guide to car insurance coverage in Washington State.

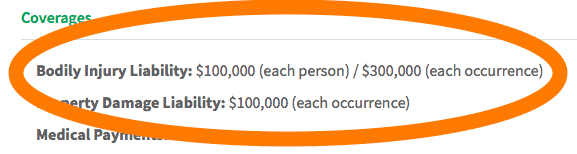

Liability coverage

What it does: Pays medical bills and other damages if you cause a car crash that injures other people.

What it doesn’t do: Pay for your injuries, or damage to your vehicle.

Who needs it: Everyone. This is the bare minimum of auto insurance and is required by law if you own and operate a car in Washington.

In addition, you want to make sure you have proper coverage to protect your assets, in case you cause serious injuries to someone.

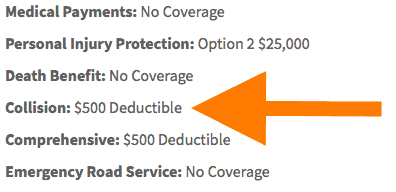

Collision coverage

What it does: Pays for damage to your vehicle.

What it doesn’t do: Pay for injuries. Collision coverage is only for property damage, and there is usually a deductible.*

Who needs it: This insurance is usually required if you have a car loan.

Comprehensive coverage

What it does: Pays for damages like broken windows, parking lot dents, or break-ins.

What it doesn’t do: Pay for damage caused by a crash.

Who needs it: It’s often required when you lease a vehicle. There is usually a deductible.*

Related Article: Who Pays for Car Damage in a No-Fault State

Medical payments coverage (Med-Pay)

What it does: Pays your medical bills after an auto accident collision, and those of your passengers. It does not matter who is at fault for the crash.

Some states require this insurance. It is also called Med-Pay, or PIP (Personal Injury Protection).

What it doesn’t do: Cover any injuries that the insurance company deems to be unrelated or pre-existing. Most Med-Pay doesn’t cover wage loss—but most PIP does—so it’s worth reading this part of your policy carefully.

Who needs it: It’s usually worth adding Med-Pay to your car insurance coverage if it is not already required by your state.

Recommended Article: Not Enough Insurance Can Cost

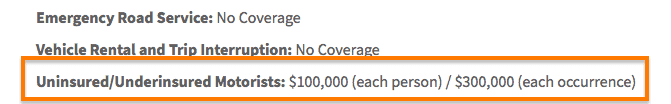

UM/UIM (Uninsured / Underinsured Motorist)

What it does: Pays for damages and injuries if the driver who caused the collision does not have car insurance.

This insurance also covers you if the other driver does not have enough insurance to pay for all of the damage.

UM stands for Uninsured Motorist. UIM stands for Under-insured Motorist.

What it doesn’t do: Kick in right away. UM claims usually need proof that the at-fault driver was uninsured at the time of the car crash. UIM doesn’t kick in until the other driver’s insurance reaches the maximum they could possibly have to pay out.

* What is a deductible? It is the amount of money you have to pay out-of-pocket. Once you have paid your deductible, your insurance pays the remainder.

See the Washington State Office of the Insurance Commissioner for more information.

The information provided is meant to give a general and basic idea of car insurance coverage in Washington State. No advice, legal or otherwise is being provided. You should consult your insurance agent/company to obtain specific details regarding your car insurance coverage.

If you were in a collision, see this guide to post-crash car insurance.

4 Responses

It’s nice that you provided a quick guide on how to choose the right car insurance. Since this is my first time choosing a coverage policy for my vehicle, I appreciate that you included complete details for each type. Perhaps, I shall then select one the liability coverage since you mentioned that covers medical bills and other damages incurred if a car crash happens and there are people involved. Hopefully, I can find a reliable provider here in town.

It’s good to know that collision coverage only pays for vehicle damage. I am graduating college at the end of the year, so I need to get on my own insurance plan. I may want to opt for collision coverage since my car is relatively new.

My husband and I would like to buy a new car soon so that we can have a more reliable mode of transport, and we are trying to decide which insurance policy would be best for us. Thanks for mentioning that collision coverage can help pay for damage to your car. I think that would be a great choice for us since it will be a new car, but we’ll have to talk to a professional about what else we should add in too.

Thanks for your comment! There are a lot of different factors here, but if this situation occurred, you should speak to a lawyer. If it’s helpful, you can reach Coluccio Law at 206-826-8200.