Some of the saddest cases we see are those in which there is just not enough car insurance to pay medical bills and adequately compensate someone who’s been seriously hurt in a crash.

Recently, Coluccio Law represented a young man who was riding in his co-worker’s car when the vehicle flipped. His arm was trapped under the side of the car, and he sustained serious injuries to his arm that nearly resulted in amputation.

We were able to assist him in a personal injury claim resulting in the payment of full insurance policy limits. But, in this case—like others we have seen—there just wasn’t enough insurance to cover his medical, and damages and losses.

Washington State only requires minimum liability insurance of $25,000 per crash. The medical bills, damages and losses from this crash would have exceeded even a $100,000 liability insurance policy.

In a very similar case several years ago, we were able to secure a significantly larger settlement for our client, simply because there was significant insurance to cover the bills, damages and losses.

Options for when there’s not enough car insurance

Injured people can suffer a huge financial loss when the at-fault driver’s insurance policy is maxed out before medical bills are paid. Here are some of the ways to minimize the loss.

Personal payments

There have been some cases in which we have been able to negotiate a personal payment by the at-fault driver, in addition to the maximum available insurance.

While you may have the right to file a lawsuit against the at-fault driver and ask for a personal payment, this method is rarely successful. Most people who have assets that could be liquidated to cover their medical bills and damages are likely to have had sufficient insurance to protect their assets.

A person who has only minimum insurance coverage is unlikely to have significant assets to obtain monies over the insurance limits. Even if you were able to get a trial verdict in your favor, actually collecting on it is a whole other challenge.

UM/UIM Insurance

If you have a car insurance policy in Washington, then you have the opportunity to have UM/UIM insurance. If a family member in your household has car insurance, then you may be able to access their UM/UIM insurance.

UM/UIM insurance pays for damages and injuries if:

- The driver who caused the collision doesn’t have a car insurance policy—an uninsured motorist (UM); or,

- The driver doesn’t have enough car insurance to pay medical bills and other damages—an under-insured motorist (UIM).

When the at-fault driver doesn’t have enough insurance, you can access your UIM policy. UIM insurance doesn’t kick in until the other driver’s insurance reaches the maximum they could possibly have to pay out.

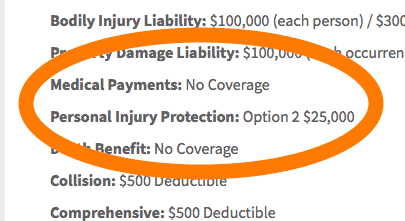

Medical payments coverage

Medical payments coverage can pay some of your medical bills after a crash, regardless of who is at fault. Some states require this insurance. It is also called Med-Pay, or PIP (Personal Injury Protection).

Med-Pay won’t cover any injuries that the insurance company deems to be unrelated or pre-existing. Most Med-Pay doesn’t cover wage loss—but most PIP does provide that benefit. If you have your own car insurance policy, it is worth checking the policy carefully.

Recommended Article: PIP Payout

Using your own health insurance

If you have health insurance, you can use it to pay hospital and doctor bills.

When you file a personal injury claim, your health insurer can try to recover the costs from the at-fault driver. This is called subrogation. Subrogation means that your health insurer can be reimbursed out of the proceeds of a settlement or verdict.

In Washington State, the “Made Whole Doctrine” limits subrogation when there isn’t enough car insurance to pay medical bills and other damages.

If you have a health savings account (HSA) that you can use to cover medical bills, it is not subject to subrogation.

Negotiating bill reductions

One of the ways we help our clients is by negotiating balances with the doctor’s office or billing agencies.

An injured person can always attempt to negotiate their own bills. However, car crash lawyers and paralegals very frequently deal with doctors’ offices and medical billing, which is a big advantage in negotiating bill reductions.

Filing Crime Victim Claims

In Washington State, there is a crime victims’ compensation fund that might be able to help you if there’s not enough car insurance to pay medical bills.

If the driver who caused the crash committed a crime – such as driving under the influence – then you may be eligible for crime victim’s assistance.

The Washington State Department of Labor and Industries administers the Crime Victims Compensation Fund. Contact them with questions about eligibility and filing a crime victim’s claim.

Questions about what to do when there’s not enough car insurance?

You can contact us for a free consultation, or for additional information.

Photograph credit: Annie Spratt, via Unsplash

Services We Offer

- Car Crashes

- Bicycle Crashes

- Burn Injuries

- Brain Injury Law

- Motorcycle Crashes

- Spinal Cord Injuries

- Pedestrian Injuries

- Train Crash & Maritime Injuries

- Truck Crash Law

- Wrongful Death