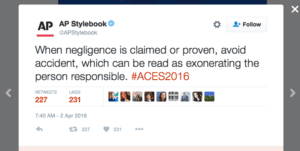

Managing a claim on your car insurance after a serious accident crash* can feel overwhelming.

There are a few simple things you can do to help make the insurance claims process easier.

How to organize your crash information

Depending on the number of vehicles and people involved in the crash, there may be multiple insurance companies and insurance adjusters involved.

Claims can get complicated quickly, and you may find it useful to start a file. Gather together all of your information, and separate it by categories such as:

- Medical bills and expenses;

- Police reports;

- Photographs of the scene;

- Property damage estimates;

- Work time lost, and

- Correspondence from insurance companies or law firms.

About your car insurance

Make a list for your file so you can quickly access all the relevant information about your car insurance company.

- Policy #: __________________________________

- Adjuster’s Name: ____________________________

- Adjuster Contact Information: ___________________

- Claim #: __________________________________

There may be a separate adjuster for Personal Injury Protection (PIP). If so, note the PIP Adjuster’s name and contact information.

About the other driver’s car insurance

Your insurance company may be dealing with the other driver’s insurance company, but take note of the following information:

- Adjuster Name:_____________________________

- Adjuster Contact Information: ___________________

- Name of Insured: ____________________________

- Policy #: __________________________________

- Claim #: __________________________________

How to talk to the insurance company’s claim adjusters

Sometimes, people assume that they don’t need to contact their own car insurance about a crash for which they were not at fault. If you haven’t already contacted your own car insurance company about the crash, do so immediately. This will start the process of your crash claim.

If you haven’t already contacted your own car insurance company about the crash, do so immediately.

Adjusters are usually friendly and helpful at the start of a car crash claim.

But remember this: insurance adjusters work for insurance companies—not for you.

They do, however, have an obligation to protect your interest and treat you fairly.

Speak carefully.

Be polite to the adjuster, but remember: that person’s job is to pay as little as possible for your claim.

Adjusters will look for any possible reason to deny part of your claim. Anything and everything you say may be used against you.

How to protect yourself after a car crash

Get the medical attention you need.

An injured person who returns to work too quickly, or stops medical treatment before they are healed, can end up having a terrible relapse.

Get help immediately: it will be much more difficult to access your insurance benefits later.

Do not give a recorded statement.

If the adverse driver’s insurance company asks you to give a recorded statement, you should speak with an experienced personal injury lawyer first. It is your legal right to speak with an attorney before giving a statement on the record.

Know that insurance companies investigate claims.

If you were involved in a serious crash, you should know that it will likely be thoroughly investigated. Experienced plaintiff’s lawyers also conduct detailed investigations into serious car crashes.

Big car insurance companies have the resources to send out investigators and adjusters to the scene of the crash. They might have looked at the vehicles, talked to witnesses, and gathered “evidence” before you are even out of the hospital.

In order to protect yourself, you may want to talk with a lawyer about possibly investigating the incident while witness memories are fresh and the crash scene is preserved.

This information is not intended to provide legal advice or legal opinions; it is general information and may not apply to claims outside of Washington, Oregon, or to your claim.

Questions? Contact Coluccio Law for a free consultation.

That’s not a series of “accidents”—it’s a public health crisis.

Why we stopped talking about “car accidents” – and you should, too …

Recommended Article: Not Enough Car Insurance