In June, the US House of Representatives passed a transportation bill – HR 2577– with a strange provision: it stops the Department of Transportation from updating minimum trucking insurance requirements.

Commercial truck insurance minimums haven’t changed in 30 years.

The federal government sets a “floor”: a minimum amount of insurance coverage commercial trucks must carry.

There are good reasons for this, primarily:

- Medical bills, lost wages, and other expenses from truck crashes are covered by the trucking companies, not by the injured persons or the taxpayers; and

- It establishes an entry-level safety standard for commercial truck drivers. If you can’t afford insurance, then you can’t afford brakes, tires, maintenance, etc.

The concept is good.

The practice is flawed.

The last time the commercial truck insurance minimum was adjusted for inflation, Ronald Reagan was President.

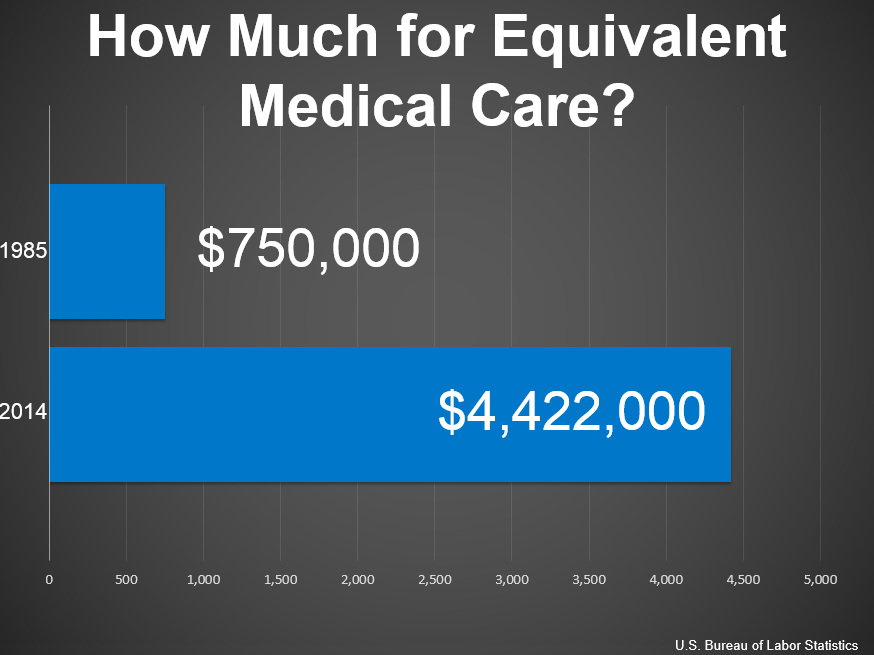

The minimum amount of insurance for a commercial truck, set in 1980: $750,000.

The minimum amount of insurance coverage in 2015: $750,000.

A trucking company that had a minimum insurance policy in 1980 still has the same amount of coverage in 2015.

The problem: costs have increased dramatically.

$750,000 no longer covers catastrophic truck crashes. The bar setting the entry-level safety standard is considerably lower.

Truck insurance needs to catch up with inflation

If minimum trucking insurance rates were tied to the rate of inflation, that number would be a little under $2 million.

In sheer buying power, the current equivalent of 750,000 dollars in 1980 is about $2,150,000.

If rates were tied to medical costs – the bills that are supposed to be covered by this insurance after a truck accident crash – the minimum would be closer to $4 million.

By every metric, the commercial truck insurance minimum is at least $1 million off—far too low.

And thousands of trucking accident crash victims are paying for it.

Congress needs to get out of the way of this long-overdue correction to trucker’s minimum insurance limits.

What happens next?

The House of Representatives attempt to interfere with the FMCSA’s long-overdue increase in insurance requirements (and rolling back trucking safety provisions). It could derail the entire transportation bill for 2015 – 2016.

The Senate version of the transportation bill, which could go to a floor vote as soon as this week, is different than the House version.

It doesn’t directly prohibit FMCSA from updating the 1980-level of minimum insurance requirements. But it does force FMCSA to give Congress an assessment of truck crashes exceeding the minimum insurance coverage, and the potential effects of increased insurance premiums for carriers.

One Response

Based on Constant Dollars, $750,000.00 in 1980, should have increased by 208.5% to $2,313,731.80 in 2019. Commercial vehicles are under insured, and crash victims are getting screwed.